The Relevance of Currency Exchange in Global Profession and Commerce

Currency exchange serves as the foundation of international trade and business, allowing smooth purchases between varied economic climates. As fluctuations in exchange rates can present considerable threats, reliable money risk management comes to be extremely important for keeping an affordable side.

Duty of Money Exchange

Currency exchange plays a critical function in assisting in international trade by making it possible for transactions in between parties running in different currencies. As organizations progressively participate in worldwide markets, the need for efficient money exchange systems ends up being vital. Currency exchange rate, which change based on various financial indicators, determine the value of one money family member to an additional, influencing trade characteristics considerably.

Furthermore, money exchange reduces risks connected with international transactions by supplying hedging options that shield against damaging currency activities. This economic tool permits businesses to maintain their expenses and profits, further promoting global profession. In summary, the role of currency exchange is central to the performance of international commerce, giving the important framework for cross-border transactions and sustaining financial development worldwide.

Influence on Pricing Strategies

The mechanisms of money exchange dramatically affect prices strategies for businesses engaged in worldwide profession. forex trading forum. Variations in exchange prices can bring about variations in prices connected with importing and exporting goods, engaging firms to adapt their prices versions as necessary. When a domestic money reinforces versus foreign money, imported items might come to be less expensive, enabling services to lower rates or boost market competitiveness. Conversely, a damaged residential currency can pump up import expenses, triggering firms to reassess their prices to maintain profit margins.

Additionally, companies should think about the financial conditions of their target audience. Neighborhood buying power, rising cost of living prices, and money stability can determine how items are valued abroad. Companies frequently adopt rates approaches such as localization, where prices are customized to every market based upon currency fluctuations and local economic variables. Additionally, vibrant rates versions may be utilized to react to real-time money motions, ensuring that companies continue to be nimble and competitive.

Influence on Profit Margins

Fluctuating currency exchange rate can greatly impact earnings margins for companies involved in worldwide profession. When a firm Click This Link exports goods, the income created frequents an international currency. If the worth of that currency decreases loved one to the company's home money, the profits recognized from sales can reduce considerably. Alternatively, if the foreign money appreciates, earnings margins can boost, enhancing the overall financial efficiency of the business.

Furthermore, companies importing products encounter comparable dangers. A decrease in the worth of their home money can cause greater expenses for foreign products, ultimately squeezing revenue margins. This situation demands effective money danger administration strategies, such as hedging, to reduce prospective losses.

Business have to remain attentive in keeping track of currency trends and readjusting their monetary techniques appropriately to safeguard their bottom line. In summary, understanding and managing the impact of currency exchange on revenue margins is crucial for organizations aiming to maintain profitability in the complicated landscape of international trade.

Market Gain Access To and Competition

Browsing the complexities of international profession needs organizations not only to handle profit margins but likewise to make sure effective click this market access and boost competitiveness. Money exchange plays a critical duty in this context, as it directly affects a company's capacity to get in new markets and contend on a global range.

A positive currency exchange rate can reduce the cost of exporting goods, making items more eye-catching to international customers. Conversely, a negative rate can blow up costs, hindering market infiltration. Companies need to purposefully handle money changes to optimize prices approaches and continue to be competitive versus regional and worldwide gamers.

Moreover, organizations that successfully make use of currency exchange can develop possibilities for diversity in markets with desirable problems. By developing a strong existence in multiple currencies, companies can reduce threats related to reliance on a solitary market. forex trading forum. This multi-currency method not just enhances competition but likewise promotes durability when faced with financial changes

Threats and Obstacles in Exchange

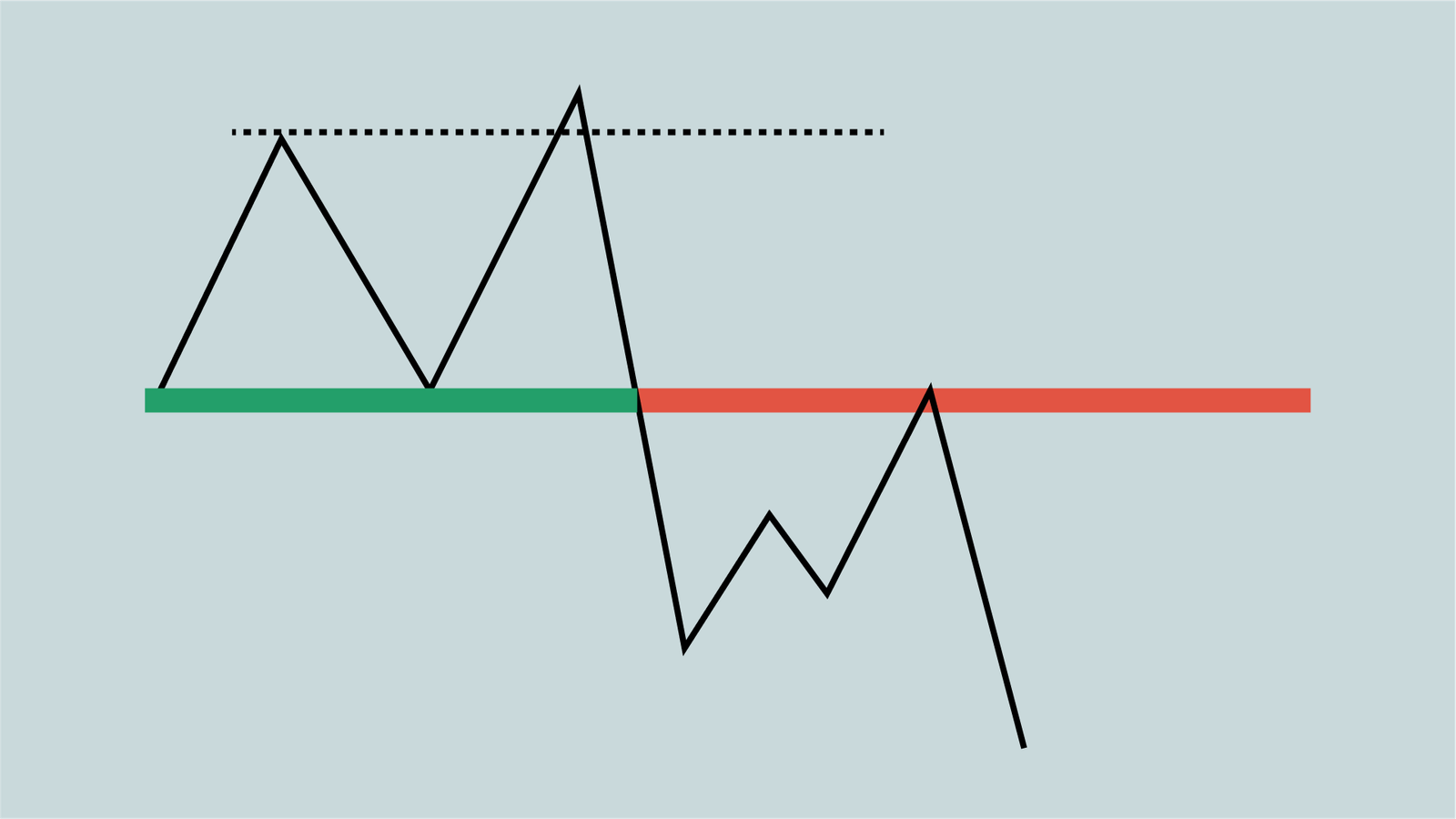

In the realm of international profession, companies encounter considerable risks and challenges related to currency exchange that can influence their monetary security and operational methods. One of the main risks is currency exchange rate volatility, which can cause unexpected losses when transforming currencies. Changes in exchange rates can influence earnings margins, particularly for companies involved in import and export activities.

Additionally, geopolitical factors, such as political instability and governing changes, can worsen currency risks. These components may lead to abrupt shifts in money values, complicating financial forecasting and preparation. Organizations have to browse the complexities of international exchange markets, which can be influenced by macroeconomic signs and Visit Your URL market view.

Conclusion

In verdict, currency exchange serves as a keystone of worldwide profession and commerce, promoting transactions and improving market liquidity. Despite fundamental risks and challenges connected with changing exchange rates, the relevance of currency exchange in fostering financial growth and durability remains obvious.

Comments on “The Ultimate Forex Trading Forum for Beginners and Experienced Investors”